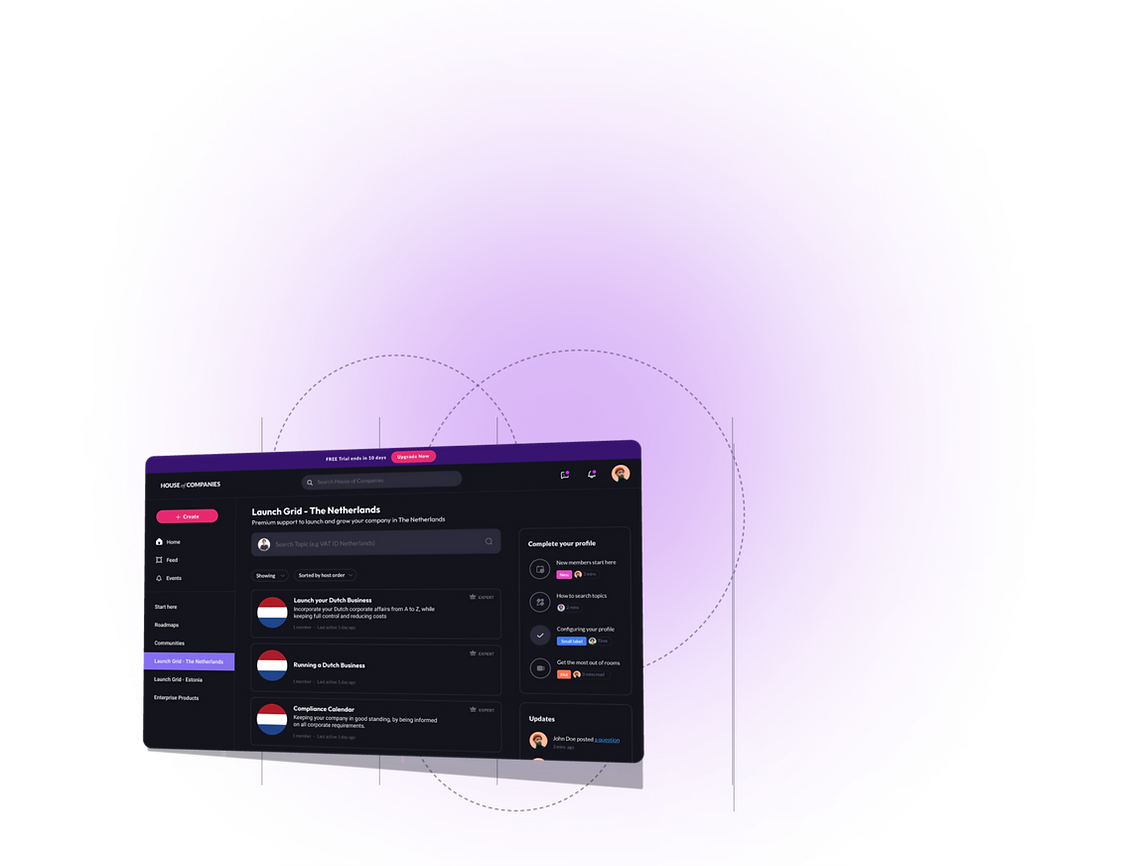

Submitting your VAT return in Ireland is crucial for compliance with the Value Added Tax Act 1972 and Irish tax laws. At House of Companies, we offer a one-stop control panel that simplifies company incorporation, VAT submissions, and global expansion. Our platform provides cost-effective solutions and expert guidance, ensuring smooth market entry in Ireland and beyond

Online portals and entity management tools simplify VAT filings, ensuring compliance and automating return calculations and submissions. These tools help businesses reduce errors, save time, and stay updated with tax laws, making VAT management seamless and efficient.

Once your first VAT return is submitted, you can use Entity Management to further run & grow your company!

"I expected it would take us two quarters to establish a profitable presence in Ireland. Thankfully, I didn't need to hire a local accountant during that time, thanks to the streamlined services from House of Companies."

Emily Jacobs

Emily Jacobs "Our VAT reports are prepared by our accountant in India, but we trust House of Companies' Entity Management system to submit them seamlessly to the Irish tax authorities."

Carlos Hernandez

Carlos Hernandez"The practical knowledge offered through House of Companies made me confident enough to take an active role in managing our tax filings in Ireland, and it paid off!"

Haruto Nakamur

Haruto NakamurHouse of Companies is here to assist you with expert support from our International Tax Officers in Ireland. Whether you are managing complex VAT issues or navigating cross-border tax regulations, our team is dedicated to providing comprehensive guidance, ensuring full compliance and minimizing tax-related risks for your business.

Let us help you manage your tax obligations seamlessly and efficiently.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!