House of Companies in Ireland simplifies e-commerce VAT compliance through the One-Stop-Shop (OSS) scheme. We handle VAT registration, calculations, and filings across the EU, ensuring timely and accurate submissions. Let us manage your VAT obligations so you can focus on growing your business.

House of Companies simplifies the process of filing your One Stop Shop (OSS) returns for e-commerce businesses. The OSS scheme allows e-commerce businesses to report and pay VAT for sales across the EU through a single online portal, rather than registering in each member state.

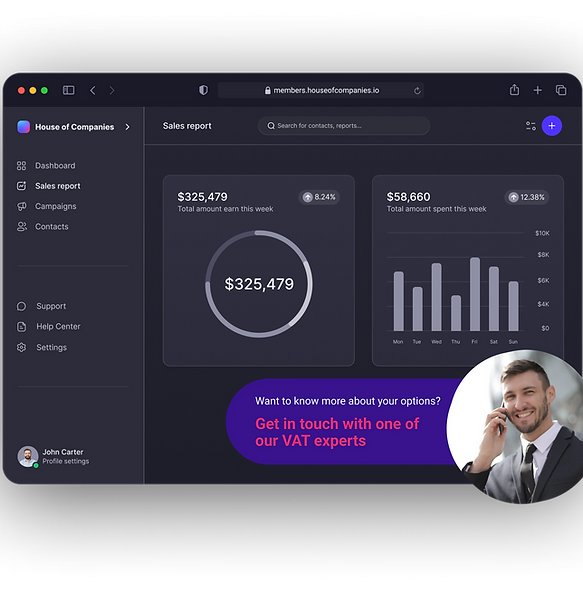

Our platform ensures compliance with the EU VAT rules, including the VAT e-commerce package effective from July 1, 2021. By using our Entity Portal, you can easily manage your OSS filings, track your sales, and ensure timely submissions, reducing the administrative burden and helping you focus on growing your business.

"House of Companies made VAT filing effortless, allowing us to expand across the EU without the stress of complex tax compliance."

E-commerce Owner

E-commerce Owner"Automating our VAT returns saved us time and money. We can now focus more on scaling our business."

Online Retailer

Online Retailer"Thanks to the automation, we avoid penalties and ensure our VAT filings are always accurate and on time."

Global Fashion Hub

Global Fashion HubFor tailored VAT support in Ireland, House of Companies offers expert guidance from European VAT specialists. We help you navigate VAT compliance, file returns, and optimize your tax strategy, ensuring you stay compliant with local regulations. Whether you're a local or international business, our team minimizes risks and maximizes efficiency. Contact us today to learn how our bespoke VAT support can benefit your business.

Our specialists provide personalized assistance to ensure your VAT filings are accurate and compliant with the latest regulations. With our expertise, you can automate your VAT returns, reduce administrative burdens, and focus on growing your business. Whether you need help with VAT registration, filing, or compliance, our team is here to support you every step of the way.

Expert Guidance: Gain access to experienced VAT professionals who provide personalized support tailored to your business needs, ensuring compliance and strategic VAT management.

Streamlined Compliance: With our automated solutions, you reduce the administrative burden of VAT filings, ensuring accurate and timely submissions across multiple jurisdictions.

Cost Efficiency: Minimize the need for additional staff or external consultants by leveraging our comprehensive VAT services, saving both time and resources.

Risk Reduction: Our experts help you avoid costly mistakes by ensuring your VAT filings are error-free and compliant with local and international regulations, minimizing the risk of penalties.

Maximized VAT Recovery: We assist in optimizing VAT recovery, helping you reclaim as much VAT as possible and improving cash flow for your business.

Global Coverage: Whether operating locally or internationally, House of Companies provides seamless VAT solutions for businesses across various EU countries, streamlining cross-border tax processes.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!