€995 . 00

per year

Automating your financial statements in Ireland not only streamlines the reporting process but also boosts accuracy and lightens the load on your team. Picture having real-time insights into your financial health without the hassle of manual data entry! By leveraging advanced technologies, you can ensure your invoices, bank statements, and agreements are processed swiftly and efficiently, freeing up time to focus on what truly matters—scaling your business.

Even with the constant changes in tax and accounting regulations, an Irish chartered accountant can be crucial to your business. Our Entity Management services are here to assist you with your tax return needs. You can provide us with your current VAT records and research, or we can help you start from scratch and develop new ones, ensuring compliance and smooth financial operations in Ireland.

The first step in preparing financial statements in Ireland is understanding the legal requirements, which typically include the balance sheet, income statement, and cash flow statement. Familiarize yourself with the Irish accounting framework, which follows the Financial Reporting Standards (FRS) and the Companies Act, to ensure compliance with local regulations.

Next, organize your financial data by gathering relevant documents like invoices, bank statements, and receipts. Consider using accounting software to simplify the tracking process. Begin by summarizing revenues and expenses in the income statement, followed by creating the balance sheet and cash flow statement. By following these steps, you can prepare your financial statements independently, ensuring your business’s financial health and compliance.

Before diving into the preparation process, it’s essential to understand the specific requirements for financial statements in Ireland. The basic components include the balance sheet, income statement, and cash flow statement. Familiarize yourself with the Irish Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) if your business operates internationally. Knowing what is required will save you time and ensure compliance.

The next step is to gather all relevant financial data. This includes invoices, receipts, bank statements, and any other documents that reflect your business's financial activities. Organize these documents by categories such as revenues, expenses, assets, and liabilities to streamline the process. Using accounting software can help you efficiently track these documents and simplify data entry, making it easier to prepare your financial statements in compliance with Irish regulations.

Now that you have a clear understanding of the requirements and have gathered your data, it’s time to prepare your financial statements. Start with the income statement to calculate your net profit or loss by subtracting total expenses from total revenues. Next, prepare the balance sheet, which lists your assets, liabilities, and equity. Finally, draft the cash flow statement to illustrate how cash flows in and out of your business.

By following these steps and remaining organized, you can prepare your Ireland financial statements without the need for an accountant, empowering you to take control of your business’s financial health!

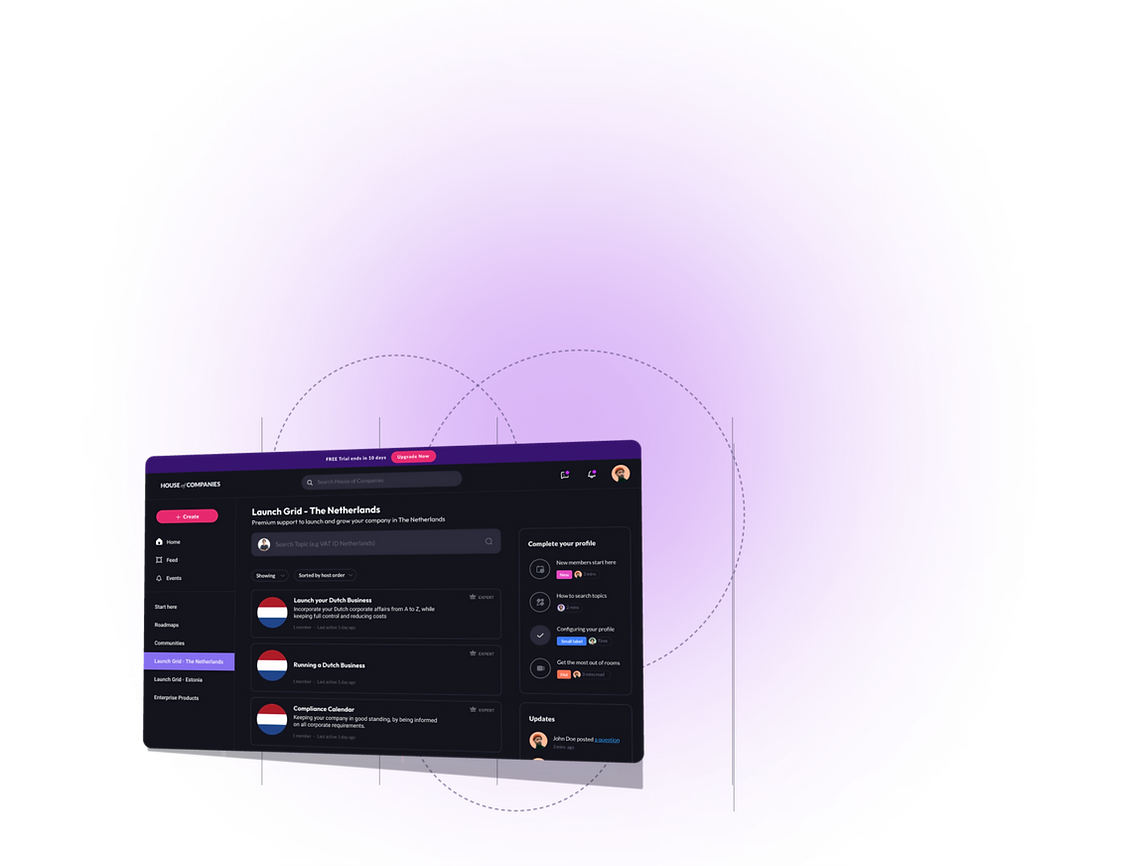

Streamlined Financial Reporting: The Entity Management Services Portal simplifies financial reporting by automatically gathering data from various sources, allowing you to generate your Balance Sheet and Profit & Loss statements with ease. This saves time and reduces the manual effort involved in financial reporting, helping you focus on other key business areas.

Real-Time Data Access: With real-time updates, the portal ensures that as transactions are made, your financial statements are instantly updated. This gives you access to accurate and current financial information at any moment, supporting better decision-making and timely adjustments to your business strategy.

User-Friendly Interface: The portal's intuitive design ensures that you don't need to be an accounting expert to navigate it. Its user-friendly interface makes it easy for business owners and managers to input data and generate financial reports, making it accessible for everyone.

Compliance with Irish Regulations: Designed to meet Irish accounting standards, the portal ensures that your Balance Sheet and P&L statements comply with local regulations. This feature removes the stress of regulatory compliance, enabling you to focus on growing your business while meeting all legal requirements.

Enhanced Financial Insights: By auto-generating financial statements in real time, the portal provides valuable insights into your business’s financial health. It helps you track performance, analyze trends, and identify areas for improvement, empowering you to make informed, data-driven decisions that drive growth and profitability.

Filing and publishing financial statements is a crucial requirement for businesses operating in Spain. This process ensures transparency and compliance with local regulations, helping you maintain a positive reputation in the market. Below, we provide an overview of the submission deadlines, as well as information on extending deadlines and exceptions.

In Spain, the deadline for filing your financial statements typically falls within six months after the end of your fiscal year. For most businesses, this means that if your fiscal year ends on December 31, you will need to submit your financial statements by June 30 of the following year. It’s essential to stay on top of these deadlines to avoid potential penalties or issues with compliance.

In certain situations, you may be eligible for an extension on your filing deadline. For example, if you face unforeseen circumstances, such as significant operational disruptions or natural disasters, you can request an extension from the Chamber of Commerce (KvK). Additionally, small businesses or newly established entities might qualify for special considerations regarding deadlines.

To request an extension, you typically need to submit a formal application outlining your reasons for the request. Be sure to provide any supporting documentation that can help justify your need for additional time. While extensions are not guaranteed, demonstrating genuine circumstances can improve your chances of approval.

It might be difficult to discuss Spain's corporate tax laws, but it can be made easier if you know the essentials. This brief guide will assist you in creating your company tax analysis and guarantee a seamless filing process.

Filing a corporate tax return: Making your business tax return (Modelo 200) is the initial step in handling your corporation tax responsibilities. This return gives the Spanish tax authorities comprehensive details on the revenue, expenses, and tax obligations of your business. Verify that all supporting documentation and financial statements are correct and prepared for submission.

Corporate Income Tax (CIT) computation and payment: After obtaining the required information, compute your Corporate Income Tax (CIT) using the relevant tax rates. The typical CIT rate in Spain is 25%, while particular industries or small enterprises may be eligible for lower rates. Once your tax liability has been determined, pay any taxes due by the due date to avoid penalties.

CIT Payment Interest: Be advised that you can be subject to interest on late payments if you don't pay your corporation tax on time. To reduce any further financial pressures, it is crucial to meet deadlines and make sure that your payments are made on time.

Audits and Compliance: Respecting Spanish tax laws is essential. Keep thorough records of all your financial transactions because the tax authorities might audit you. In addition to supporting your business tax return, proper documentation enables you to react to an audit with effectiveness.

Extensions and Filing Procedures: In Spain, you have the option of filing your company tax return in person at specific tax offices or online. Consider requesting an extension if you require additional time to prepare your return. To prevent interest costs, remember that any taxes that are still due must be paid by the original date.

Preventing Double Taxation: You might be worried about double taxation if your business conducts business abroad. In order to avoid this problem, Spain has treaties with a number of nations that permit you to deduct taxes paid to foreign governments from your Spanish tax obligations. Learn about these treaties so that you don't pay more taxes than you need to.

You may efficiently prepare your business tax analysis and file your tax return by adhering to these principles, which will guarantee adherence to Spanish laws and reduce any potential problems.

[1] - https://www.houseofcompanies.io/

[2] - https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/audit/deloitte-nl-audit-annual-accounts-in-the-netherlands-2019.pdf

[3] - https://theaccountingjournal.com/netherlands/financial-reporting-in-the-netherlands/

[4] - https://online.hbs.edu/blog/post/how-to-prepare-an-income-statement

[5] - https://www.youtube.com/watch?v=aRL1MDYFMZ4

[6] - https://www.tax-consultants-international.com/publications/accounting-and-audit-requirements-in-the-netherlands

[7] - https://www.bnnlegal.nl/en/services/insolvency-law-and-bankruptcy/directors-liability-in-the-netherlands/

[8] - https://www.linkedin.com/pulse/7-reasons-conduct-external-audit-uae-atif-iftikhar

[9] - https://www.nba.nl/opleiding/foreign-auditors/ra-qualifications/the-dutch-educational-system-for-register-accountants/

[10] - https://www.kvk.nl/en/filing/when-do-i-have-to-file-my-annual-accounts/

[11] - https://www.kvk.nl/en/filing/am-i-required-to-file-annual-reports-and-accounts/

[12] - https://taxsummaries.pwc.com/netherlands/corporate/tax-administration

[13] - https://business.gov.nl/regulation/corporate-income-tax/

[14] - https://business.gov.nl/finance-and-taxes/business-taxes/filing-tax-returns/filing-your-corporate-tax-return-vpb-in-the-netherlands/

Working with Entity Management services streamlines your business operations by ensuring compliance with local regulations and simplifying the complexities of financial reporting. These services provide expert guidance on corporate tax obligations, helping you discuss the intricacies of international laws and avoid pitfalls. Additionally, they free up your time, allowing you to focus on strategic growth while experts handle your administrative tasks. Ultimately, partnering with Entity Management services enhances efficiency and supports the long-term success of your business.

I expected to take about 2 quarters to generate turnover in Germany. Luckily I didn’t have to spend any money on an accountant in the meantime.

Global Talent Recruiter

Global Talent RecruiterMy Indian accountant drafts my VAT Reports, and submits the return using Entity Management!

Spice & Herbs Export

Spice & Herbs ExportThe practical know how in Entity Management made me comfortable to get more involved in my own tax filing! And it worked !

IT firm

IT firmFeel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!